The Ministry of Finance has proposed a possibility of cash support for companies whose revenue has declined due to the Corona virus.

Support can be granted with up to 75% of the loss of revenue. Maximum support amounts to the lowest of MSEK 150 (per Group) or the actual revenue loss.

Formal requirements

The support can be received by a natural or legal person who conducts business in Sweden and has been granted a F-tax certificate. Foundations, non-profit organizations, and religious bodies can also receive the support.

There are several mandatory criteria that must be fulfilled for a company to be able to receive the support.

- Net revenue during the latest business year of at least SEK 250 000.

- Loss of revenue of at least 30% during March and April 2020, compared to March and April 2019.

- The loss of revenue must be, almost exclusively, caused by the Corona virus.

- The company (or the parent if it is a Group), may not have distributed, or decided to distribute, dividends, or similar, in the period March 2020 – June 2021.

- The company may not have residual taxes or contributions, be prohibited to carry out business (also applicable for CEO, board members and owner), be insolvent or be subject of reconstruction (unless the decision was taken after February 29, 2020).

- Support of SEK 100 000 or more requires a certificate from an accountant.

- The application must be with the Tax Agency by August 31, 2020.

How is the support calculated?

The basis for the support is the fixed costs of the company (e.g. rent, leasing costs, interest, depreciations of fixed assets, electricity, water, draining, heating, internet, phone, insurances, royalties, and license fees). Salary costs are not included in the fixed costs.

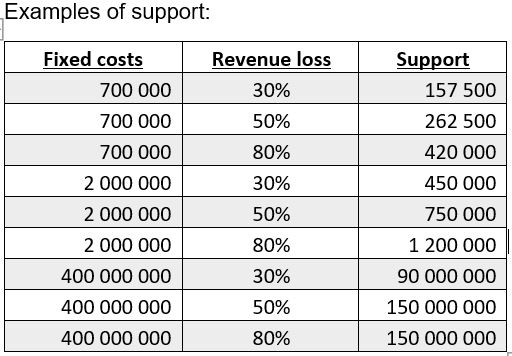

The support amounts to 75% of the fixed costs, multiplied with the level of revenue loss.

Practicalities

Payment of the support is made by crediting the company’s tax account.

The support is seen as a taxable income and is taxed in the year the support is paid. Please note that there are special rules for companies with a split financial year.

Should the support be found to be wrongfully paid or be paid with an excessive amount, the company will have an obligation of re-payment.

The support is subject to representative’s responsibility as well as penalties and the maximum penalty is two years´ imprisonment.

The rules are proposed to enter into force July 1, 2020.

If you have any questions about this, you are most welcome to contact us at Skeppsbron Skatt.